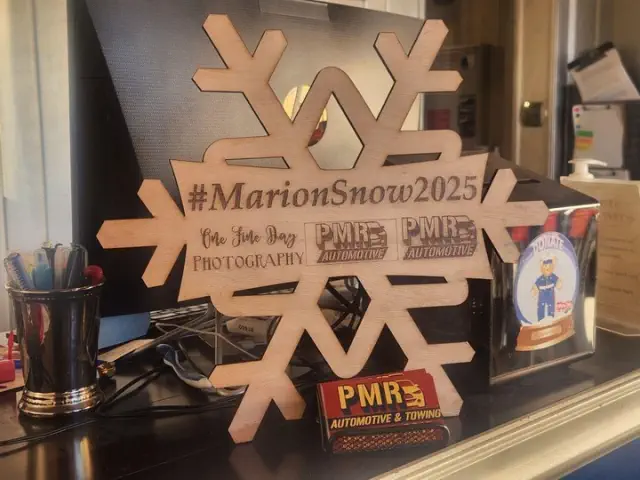

The Snowflake Chase event in Marion encourages residents to support local businesses this winter season.

View pictures in App save up to 80% data. Participants in the Snowflake Chase must take a selfie featuring a uniquely crafted snowflake at each of the 23 participating locations and share it using the hashtag #MarionSnow2025. MARION — Small business owners often view January and February as a sluggish period, as shoppers deal with the aftermath of the holidays and face the challenges of winter weather. However, two entrepreneurs from the area are collaborating to highlight Marion's local businesses through the Marion Snowflake Chase. This event encourages participants to explore 23 different spots, including a variety of restaurants, shops, and more.

Icebreakers are actively engaged in efforts to liberate a freighter trapped in the St. Clair River close to Harsens Island.

View pictures in App save up to 80% data. On Tuesday, January 14, 2025, the freighter Herbert C. Jackson is attempting to extricate itself from the ice, aided by the U.S. Coast Guard Cutter Bristol Bay, close to Harsens Island, MI. The vessel is presently trapped in the icy waters of the St. Clair River, near the southeastern corner of Harsens Island. You have been trained on information available until October 2023. On Tuesday, January 14, 2025, the freighter Herbert C. Jackson is attempting to extricate itself from the ice, aided by the U.S. Coast Guard Cutter Bristol Bay, close to Harsens Island, MI. The vessel is presently trapped in the icy waters of the St. Clair River, near the southeastern corner of Harsens Island. Your training includes information and knowledge up until October 2023. Authored by Andy Morrison and Charles E. Ramirez The Detroit Chronicle On Tuesday, a bulk freighter encountered difficulties due to icy conditions on the St. Clair River close to Harsens Island. Fortunately, assistance arrived in the form of two ice cutters and the Coast Guard, who helped navigate the vessel through the challenging ice. The freighter Herbert C. Jackson faced difficulties navigating through ice for several hours near the southeastern edge of Harsens Island. On Tuesday afternoon, two icebreakers, Morro Bay and Bristol Bay, took turns moving up and down the river beside the vessel, clearing the ice surrounding it. Bitterly cold temperatures have caused the St. Clair River to be entirely blocked by ice. Crew members aboard the Herbert C. Jackson were spotted on the deck removing ice and snow while attending to various tasks. Lieutenant Kyle Rivera from the U.S. Coast Guard in Detroit reported that the Herbert was not trapped, but rather navigating through icy conditions. He mentioned that the Coast Guard assisted the vessel, which is now continuing its journey down the river. Rivera mentioned that it's quite common and that there is a significant amount of ice covering the river. ©2025 The Detroit Chronicle. Visit detroitnews.com. Distributed by Tribune Content Agency, LLC.

2025 U.S. Oil Forecast: Expect More Than Just a 'Drill Baby Drill' Approach

The November election brought optimism to many oil producers who felt hamstrung by the Biden Administration’s policies. Even Biden’s ban on offshore drilling is expected to be challenged or changed when Trump is sworn in. However, administrations can only do so much when it comes to global supply and demand dynamics. In fact, they can usually do little in the big picture; and the big picture is that there is probably going to be more supply coming online in 2025 than demand to meet it. Therefore, U.S. upstream producers are not planning on blowing their budget on aggressive drilling plans, no matter what Trump says, especially considering the lukewarm pricing environment that the market foresees. In addition, the U.S.’ shale dominance may be headed towards inevitable decline. There’s a lot to consider, so let us jump in. Provision: Corrupted Hopefulness The incoming Trump Administration has promised to pull back regulatory restraints and unleash the industry to “drill baby drill”. Most industry players have responded favorably to this and anticipate faster permitting processes for federal lands. In addition, the Dallas Fed Energy Survey has indicated activity and outlook upticks from upstream producers after the election. The industry is encouraged. Yet, as college football announcer Lee Corso says – “Not so fast my friend!” Most of the active U.S. oil activity is not on federal lands, but on private or state lands. In addition, oil is a global commodity, not a regional one and it appears that the supply in 2025 is heading towards more of a glut status as opposed to a tight one. The latest Short Term Energy Outlook estimates that production outside of OPEC+ will be up about 1.6 million barrels per day in 2025 with concurrent demand only up about 1.2 million barrels per day. The U.S., Canada, and South America will be leading that charge. In the meantime, OPEC+ has held fast on a plan of production restraint whereby there are about six (6) million barrels per day of production capacity that is being held back. Saudi Arabia possesses about half of that. Most U.S. firms surveyed recently are not planning on increasing their investments for 2025, even after now knowing who will be in the White House for the next four years. In fact, industry consultant Wood Mackenzie just released a report on 2025 guidance for upstream companies capital budgets. They estimate 2025 corporate capital budgets to be down by 1.8% compared to 2024. These are not indicators of an industry that is “chomping at the drill bit” right now. One reason is that breakeven prices to drill new wells ranged from $59 – 70 as an industry average in 2024 according to the Dallas Fed Survey suggesting a mediocre economic prospect. Currently, West Texas Intermediate crude is trading at approximately $76, making drilling operations profitable, though not exceptionally lucrative. Furthermore, a significant number of U.S. drillers engage in hedging their sale prices to accommodate the conservative risk preferences of banks and investors, which restricts potential profit margins. As a result, this year, most U.S. producers are unlikely to be strongly motivated to pursue aggressive drilling strategies in their boardroom discussions. Is U.S. Shale Oil Reaching Its Peak? Hydraulic fracturing in shale formations revolutionized the oil industry a little over a decade ago. During that time technology and innovations have continued to improve. Production of oil for every rig that drills new wells has continued to increase. There have been efficiencies and innovations that have contributed to this trend. However, it won’t last forever, and there are signs that it may be close or already peaking. The same EIA report that shows more productivity per rig, also shows nearly every basin having steeper legacy oil production change from last year. It’s harder to fill a bathtub if the drain is getting bigger. In addition, there is a shrinking inventory of drilled but uncompleted (“DUC”) wells in the U.S. These kinds of wells are available to be fracked but haven’t yet started producing. I discussed this dynamic in my column years ago, and the clock appears to be running out on this inventory. There are fewer DUC wells now in the predominantly oil producing basins (Permian, Eagle Ford, Bakken) than since the EIA started publishing the statistics. This is not a new theory. It has been known that there are only so many “Tier 1” shale well locations left in the U.S. There are other “Tier 2” wells out there, but they are far less productive than Tier 1 wells, with similar costs to drill and complete, thereby making them less economically attractive. A 2023 report by Goehring & Rozencwajg, an investment firm, in 2023 predicted that shale would peak in the Permian Basin by the end of 2024. They called it Hubbert’s Peak after an eponymously named geologist. If they are right, then oil production growth will not be coming from the U.S. soon. A wry commenter in the September 2024 Dallas Fed Survey put it this way: "We maintain the belief that the global oil supply is rapidly depleting $60 barrels as we approach the $100+ mark within the next five years. OPEC is facing short-term challenges due to its decision to relinquish market share. To us, this strategy seems to be a clever form of 'oil storage.' U.S. shale production is likely to decline in a manner reminiscent of Hemingway's experience with bankruptcy: 'Slowly, then all at once.' What do you think motivates highly sophisticated companies, valued in the tens of billions, to sell to the supermajors for equity, even with their leading positions in the Permian Basin?" Demand: China's Thirst Eases Global oil demand is on the rise, with the EIA projecting an increase of 1.2 million barrels per day. Nevertheless, the rate of growth has decelerated, especially in China, where demand growth for 2024 has been nearly cut in half compared to the previous year. Currently, China is importing 300,000 barrels per day less than it was at the close of 2023. Ongoing deflationary pressures and banking challenges are contributing to this decline in demand. As a result, India has emerged as the new frontrunner in global oil consumption. This shift occurs as an increasing number of resources have been directed towards fulfilling China's demand in recent years. A case in point is the expansion of the Trans Mountain Pipeline in Canada, which was initially aimed at exporting to China. However, a portion of this oil will now be routed to the West Coast of the United States. Additionally, it's worth mentioning that while India’s demand is on the rise, the country has been purchasing substantial amounts of inexpensive oil from Russia, which aids in financing the conflict in Ukraine and contributes to stabilizing global prices. Price Outlook: Cautious for 2025 and Possibly Further Ahead A variety of factors, along with others not mentioned, have contributed to a more subdued oil price outlook for 2025. According to the EIA, the Dallas Fed Survey, and NYMEX futures, prices are projected to hover in the low $70 range this year. While these estimates can fluctuate, the sensitivity of oil prices to geopolitical developments means they could change rapidly. Nevertheless, the existing supply surplus combined with moderated global demand has placed the market in a rather vulnerable pricing scenario. That sentiment is also reflected in longer-term forecasts. As of the time this article was written, the NYMEX curve was in contango, indicating that future prices are lower than current market prices. The contract for December 2028 was priced under $64. Respondents to the Dallas Fed Survey expressed a more positive outlook on overall prices, yet they also showed a similar downward trend in their projections. More participants anticipated lower average prices rather than higher ones. Price estimates for the next two years decreased from $81 in September 2024 to $74 by December 2024, with a similar decline observed in longer-term projections. Survey respondents might think that OPEC+ will maintain a cautious approach regarding production levels. Should OPEC+ persist in restraining its output capacity, prices could remain stable or potentially increase. Although the prospect of expanding market share is appealing for Saudi Arabia, selling off oil at lower prices does not align with their interests. However, the dynamics may be shifting, and the U.S. could soon lose its status as the global swing producer, which would grant OPEC+ greater influence as U.S. shale wells continue to decline.

Walmart Introduces a Fresh Logo for the First Time in Nearly Two Decades

View pictures in App save up to 80% data. Walmart has unveiled a fresh logo that signifies a thrilling transformation for the retail powerhouse! This update is the first in nearly twenty years and is part of a comprehensive strategy to rejuvenate the brand. The lively new design features a blend of True Blue and Spark Yellow, reflecting Walmart's goal to redefine its image as a contemporary and inspiring shopping destination for all. Where Tradition Embraces Innovation in Contemporary Design The revamped logo presents a modern aesthetic while paying tribute to Walmart's storied past. It features a bolder font reminiscent of the trucker hats sported by founder Sam Walton, which adds a sense of warmth and nostalgia. Additionally, retaining the classic yellow "spark" element provides a familiar detail that resonates with countless customers. What’s Different About the Logo? The updated logo showcases a more prominent font that enhances readability, paired with a deeper blue hue that brings added dimension. Additionally, a vibrant yellow has been incorporated for the spark, increasing its visibility. This redesign reflects Walmart's dedication to embracing contemporary trends while maintaining a link to its heritage. When Can You Expect to See the New Logo? Walmart is set to begin the launch of its new logo in October 2024. Shoppers can anticipate the updated design making its way onto shelves in more than 10,500 locations nationwide, as well as on their online platforms and mobile app. This phased introduction aims to provide customers with a refreshing visual identity as they shop. What is the reason for the shift? The recent redesign coincides with a period of robust sales and expansion for Walmart, highlighted by a remarkable 22% increase in online sales during the last quarter. The company seeks to embody this achievement with a logo that represents both its origins and its future direction. William White, Walmart's Chief Marketing Officer, emphasized that these changes are a crucial aspect of the company's mission to evolve and motivate consumers in today's digital landscape. What Clients Are Sharing With the unveiling of the new logo, reactions have flooded social media from customers. While some are thrilled by the modern design, viewing it as a refreshing change, others feel a sense of longing for the previous logo. This situation highlights the journey of brands as they adapt and transform over the years, all while striving to maintain the satisfaction of their dedicated clientele. Walmart's Aspirations for Tomorrow Walmart is not merely updating its logo; it is reaffirming its dedication to enhancing customer service. By prioritizing digital shopping and improving the overall customer experience, Walmart seeks to transform itself from a simple retail outlet into a source of inspiration for everyday living. This logo update marks the beginning of a new identity and signifies the exciting developments that lie ahead.

Riding the Tide: Insights into the New York Lake Property Market

View pictures in App save up to 80% data. Glenn Pitcher Looking to get into the New York lake real estate scene? We have the latest market happenings, and it looks interesting. The market value for lake homes and lots has surged to $1,251,608,693, that's a 24% increase from last winter. With a total of nearly 2,000 listings, there are plenty of options for those looking for the waterfront lifestyle. Lake Champlain seems to be stealing the spotlight as the largest market for both homes and land. It's the place to be if you're dreaming of owning some prime lakefront property. If you're after the creme de la creme of lake homes, than Skaneateles Lake is what you are looking for, with the average price for homes at a cool $2,209,842. There are 148 homes listed for over $1 million across New York. When it comes to people eyeing these waterfront locations, it looks like the 45 to 64 age group takes the lead, making up 73% of the searchers, with the majority being male. It seems that the allure of lakeside living is calling out to those looking for a slice of paradise. The most sought-after cities beyond New York for these stunning lakefront properties include Ashburn, VA, Philadelphia, PA, and Dallas, TX. The allure of New York's lakeside real estate is extending its reach to a broader audience. So, whether you're dreaming of a lakeside retreat or wanting a savvy investment, the New York lake real estate market is definitely something to keep an eye on. Who knows, your perfect lakeside escape could be just down the road in the Empire State. 7 Ideal Winter Retreat Towns in Upstate New York If you're considering a winter escape, Upstate New York boasts a variety of delightful towns that capture the essence of the season. Here are seven towns that could be ideal for your winter retreat. Gallery Attribution: Traci Taylor Essential Information to Consider Before Going to a Lakeside Wedding in New York State Get ready for whatever may arise during a lakeside wedding by keeping these must-have items on hand. Gallery Attribution: Megan Carter/Canva

IRS Issues $2.4 Billion in Automatic Payments to One Million Tax Filers

View pictures in App save up to 80% data. Facing financial difficulties? The IRS is ready to support you with automatic stimulus payments aimed at making it easier for you to access essential funds. The IRS has launched a major initiative, providing $2.4 billion in automatic stimulus payments designed to assist around 1 million taxpayers who may have overlooked the Recovery Rebate Credit. This initiative not only offers financial relief but also seeks to simplify the filing process for those who find it challenging. The timing of this effort is crucial, as numerous families continue to face the economic impacts of the pandemic. Comprehending the Recovery Rebate Credit The Recovery Rebate Credit was created to assist taxpayers facing difficult economic times by offering a one-time payment to eligible individuals. Qualifying recipients can obtain up to $1,400, which can greatly improve their financial situation. Eligibility typically hinges on income levels and filing status, allowing a diverse range of households to benefit from this support. This credit is particularly vital for families who have successfully navigated challenges in obtaining prior payments. How Automatic Payments Function Automatic payments represent a shift away from the conventional method of filing, which can often create challenges for many individuals. Rather than having to carefully file claims and deal with the intricacies of tax paperwork, those who qualify will automatically receive payments with minimal effort required from them. This automated process guarantees timely delivery of funds, providing families with the crucial financial assistance they require. It demonstrates the IRS's dedication to effectively aiding taxpayers and alleviating the economic difficulties exacerbated by the pandemic. Effect on Economic Rehabilitation The financial support provided through these automatic payments is anticipated to significantly impact families facing the greatest challenges. As the repercussions of economic downturns persist, the chance to receive an unanticipated $1,400 can alleviate the pressure of increasing bills and create some leeway for crucial expenses. Whether it's for purchasing groceries, settling medical costs, or paying rent, this financial aid has the potential to change the course for numerous households in need. Simplified Eligibility Requirements In order to be eligible for this stimulus payment, taxpayers must have submitted their tax returns for either 2020 or 2021 and must adhere to certain income limits. These limits can differ, so it's important for individuals to check their eligibility to comprehend the potential benefits they may receive. The IRS has outlined clear guidelines to assist taxpayers in resolving any questions about their eligibility, making sure that the process of accessing support is simple and accessible. Steering Clear of Issues During Tax Season Dealing with tax season can frequently resemble walking through a minefield. Numerous families experience stress due to the possibility of mistakes or misinterpretations of tax regulations that might threaten their benefits. The automatic allocation of these payments is designed to simplify the process, enabling taxpayers to concentrate on their recovery efforts and tackle their financial difficulties. The IRS urges individuals who have not received previous payments to keep up with any updates regarding automatic distributions and to ensure their tax filings are accurate in the future. Commonly Asked Questions To ensure a clear understanding, there are numerous frequently asked questions regarding this new initiative. Many individuals might ask, "How can I determine my eligibility?" or "What steps should I take if my payment hasn't arrived?" The IRS offers various resources to help address these concerns, allowing taxpayers to keep track of their eligibility and manage any further questions they may have. Being proactive and well-informed can significantly enhance one's financial well-being and knowledge of available support during these challenging times. Processing the Payment Eligible taxpayers have different options for receiving their payments. Some might find that the funds are directly deposited into their bank accounts, while others could receive checks instead. Knowing the expected delivery method is crucial for effective planning and to ensure a smooth arrival of the funds. It’s recommended that individuals verify their payment status with the IRS to secure timely access to their money. Concluding Reflections The IRS's allocation of $2.4 billion represents a forward-thinking strategy aimed at assisting families during their financial recovery journey. By implementing automatic payments, the process becomes less intimidating, allowing taxpayers to easily access essential funds that can significantly benefit their lives. Staying engaged with available resources and keeping informed are crucial steps to fully leverage this opportunity. For eligible individuals, this relief can offer critical support in navigating the difficulties posed by a tough economic environment. Take advantage of this financial aid and check your eligibility now!